India Leads Asia Pacific Hotel Recovery in April 2025 Amidst Global Travel Boom

Mumbai, New Delhi, Bengaluru, and Rajasthan Drive Double-Digit Growth as India Outshines Regional Peers

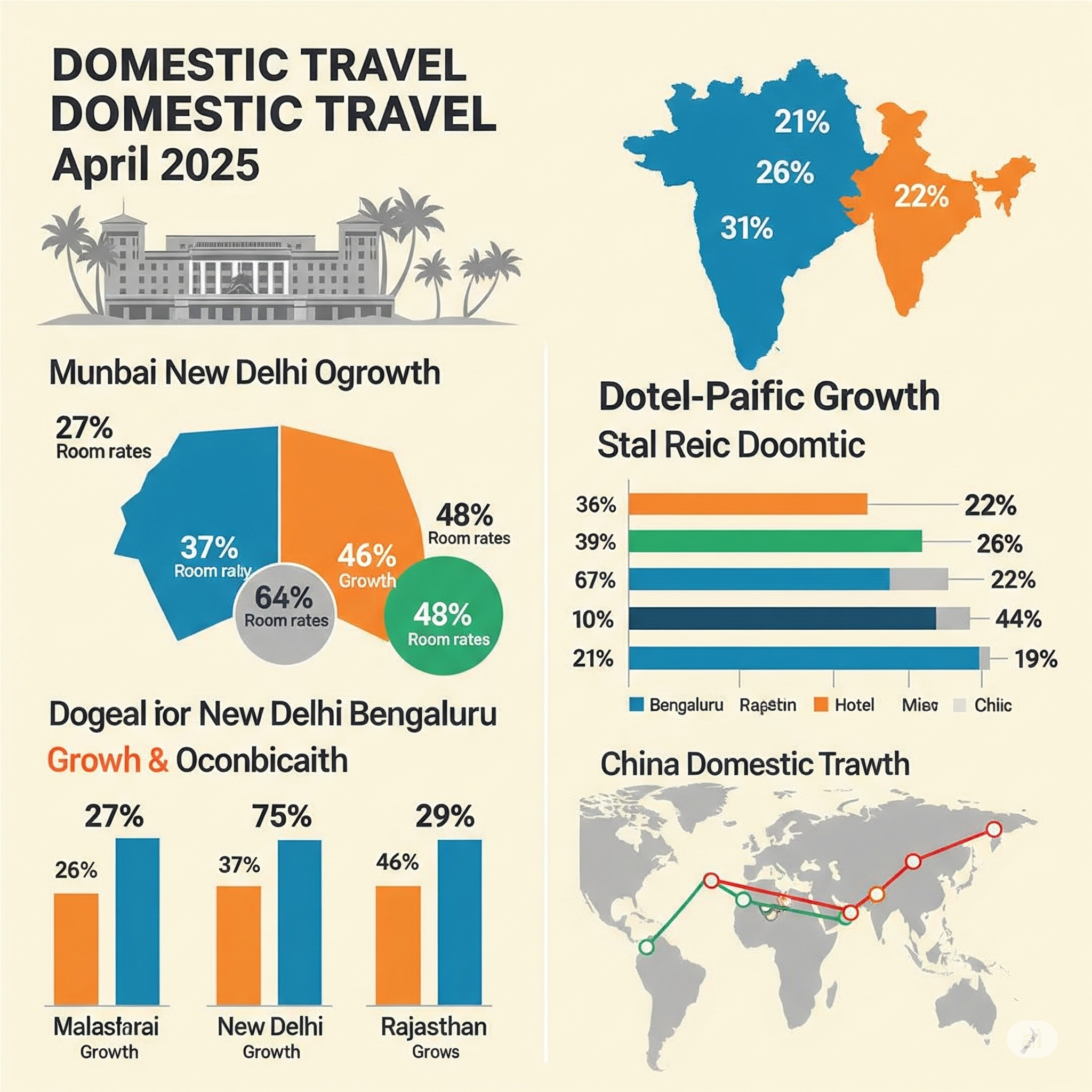

In April 2025, India emerged as the frontrunner in the Asia Pacific hotel recovery, fueled by a significant local travel boom in key markets like Mumbai, New Delhi, Bengaluru, and Rajasthan. These cities reported robust double-digit increases in both hotel occupancy and rates, as travelers returned in large numbers for both business and leisure. This strong domestic demand propelled India to the forefront of the region, contrasting sharply with China's hospitality industry, which continued to grapple with oversupply and muted international demand.

Overall, the Asia Pacific hotel industry experienced largely positive momentum in April 2025, with post-pandemic travel appetite remaining strong across many key markets. Ten of the region's sixteen largest hotel markets witnessed year-on-year growth in occupancy, average daily rates (ADR), and revenue per available room (RevPAR), indicating sustained demand for both leisure and business travel. However, the region's performance remained uneven, influenced by seasonal travel, economic shifts, and event-driven tourism.

Japan's hotel sector flourished, achieving standout success during its peak cherry blossom season, with cities like Tokyo, Kyoto, and Osaka experiencing full or near-full occupancy. This was further aided by a favorable exchange rate and the ongoing international exposition in Osaka.

In contrast, China's hotel industry faced mounting pressure, with RevPAR declining across much of the country due to weaker occupancy rates, particularly in major cities grappling with oversupply from rapid hotel expansion. However, leisure destinations like Sanya and Macau SAR saw improved performance.

The Central South Asian region, including India, the Maldives, and Sri Lanka, also demonstrated significant growth, capitalizing on rising regional travel demand and strong domestic tourism. Southeast Asia presented mixed results, with strong performance in Vietnam and Indonesia, while Malaysia and Singapore saw modest gains. Thailand and the Philippines faced challenges with declining occupancy. The Southern Hemisphere countries (Australia, New Zealand, and Fiji) enjoyed stronger performance, benefiting from seasonal cooling and favorable exchange rates.

Religious holidays like Ramadan, Easter, and Passover significantly shaped travel trends in April, influencing occupancy and RevPAR variations across the region.